[ad_1]

Automating your funds is like setting your monetary life on cruise management. It’s a easy, efficient means to make sure you stick with your finances and meet your monetary targets with out the stress of fixed monitoring. Whether or not you’ve been infamous for paying payments late or simply wish to streamline your financial savings technique, automating your funds is usually a game-changer. And guess what? It’s not as sophisticated because it sounds! Let’s dive into how one can put your cash on autopilot and take the effort out of managing your funds.

What does it imply to automate your funds?

If you automate your funds, you’re basically letting know-how take over the repetitive duties of paying payments and saving cash. Consider it as setting your cash to run on autopilot, the place your monetary obligations are met routinely, and your financial savings develop with out you lifting a finger.

By automating your funds, you get rid of the danger of falling behind in your payments and getting hit with late charges. Plus, you make saving cash a no brainer as a result of it occurs routinely.

As soon as every little thing is about up, your function is just to keep watch over issues to make sure your monetary plan stays on observe. It’s a surefire method to arrange your funds with minimal effort.

Automating my funds has really been a recreation changer, particularly given the whirlwind of tasks that include elevating youngsters and managing each a house and a enterprise. As a mom, my days are stuffed with fixed calls for—whether or not it’s juggling work deadlines, managing family duties, or just making an attempt to carve out high quality time with my kids. On prime of that, operating a enterprise provides a further layer of complexity and time dedication.

How automating my funds has made my life simpler

Earlier than I started automating my funds, holding observe of every little thing felt overwhelming generally. Payments would generally slip via the cracks, and I’d discover myself scrambling on the final minute to cowl bills or transfer cash round.

The stress of managing these monetary particulars on prime of every little thing else was all the time behind my thoughts, including pointless strain to an already full plate.

After I determined to automate my funds, it felt like a weight was lifted. I arrange computerized invoice funds, scheduled transfers for financial savings and investments, and even automated my finances monitoring. Out of the blue, I had fewer selections to make every day and fewer to fret about when it got here to managing cash.

This shift allowed me to focus extra on the issues that matter most—spending time with my household, rising my enterprise, and even discovering moments for self-care.

Realizing that my funds are operating easily within the background offers me peace of thoughts and the psychological area to sort out the extra essential features of my life.

In essence, automating my funds has not solely helped me keep on prime of my monetary targets, nevertheless it has additionally given me the liberty to be extra current within the areas of life that really matter. It’s been an important software in serving to me stability the calls for of motherhood, house life, and entrepreneurship.

What sort of monetary accounts are you able to automate?

The excellent news is which you can automate nearly each side of your monetary life! Right here’s a fast rundown of what you may set on autopilot:

Invoice funds:

- Lease or mortgage

- Utilities (gasoline, electrical energy, water)

- Bank cards

- Loans (scholar, auto, private)

- Insurance coverage (well being, auto, house)

Financial savings and investments:

- 401(okay) and different retirement accounts

- Emergency fund

- Brief-term financial savings targets (like holidays or new devices)

- Funding accounts (like your brokerage or IRA)

If it’s a monetary accountability or a financial savings objective, chances are high you may automate it. This implies fewer duties for you and extra peace of thoughts understanding your cash is working for you within the background.

How you can arrange automated funds

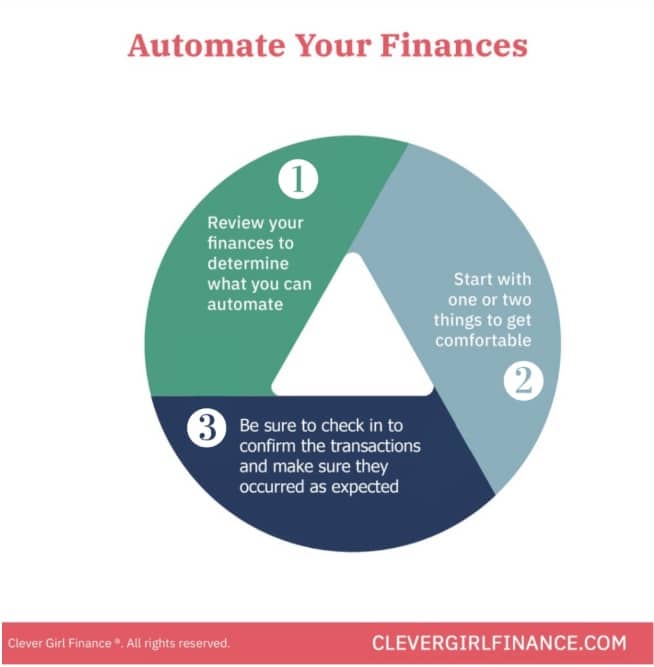

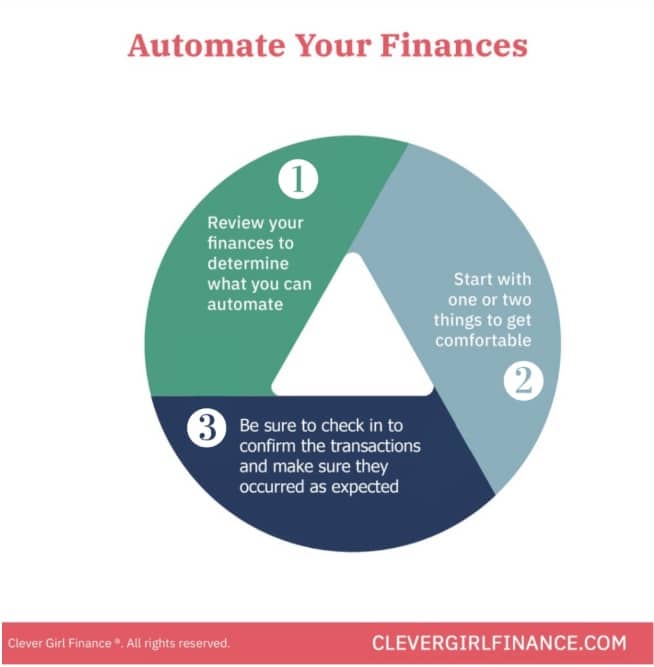

Able to get began? Right here’s how one can automate your funds:

1: Join computerized funds along with your suppliers

That is essentially the most simple possibility. By enrolling in computerized funds straight along with your service suppliers (like your utility firm or bank card issuer), you enable them to withdraw the required quantity out of your checking account on a specified date every month. No extra missed funds, no extra late charges!

For instance, in case your gasoline invoice is due on the third of each month, you may set it up in order that the cost is routinely debited out of your account on the first. Some suppliers even can help you use a debit or bank card, although utilizing your checking account typically helps you keep away from further charges.

The identical goes for financial savings: arrange an computerized switch out of your checking account to your financial savings account, and watch your financial savings develop with none further effort.

2: Use your financial institution’s invoice pay service

If a few of your suppliers don’t provide an computerized cost possibility, no worries—most banks (e..g Chase, Financial institution of America, and so forth) have gotten your again with their very own invoice pay service.

You present your financial institution with the account particulars of your collectors, they usually’ll deal with the remaining, making certain funds are despatched out on time. That is notably helpful for these old-school firms that also desire checks.

Be sure you give your financial institution sufficient time to course of these funds so that they arrive earlier than your due dates. This manner, you’ll keep away from any potential complications from late funds.

3: Arrange direct deposit along with your employer (in case you have the choice)

Earlier than you go all-in on automation, guarantee your revenue is routinely deposited into your account. Most employers provide direct deposit, which is a lifesaver. Your paycheck is deposited into your account on payday, and you realize precisely when your funds will probably be obtainable.

Some employers even allow you to break up your paycheck between a number of accounts. This implies you may allocate a portion on to financial savings or investments, making automating your funds even simpler.

Professional tricks to efficiently automate your funds

Happily, it’s fairly straightforward to automate your funds and schedule recurring funds or deposits between several types of financial institution accounts. Listed below are a number of ideas to make sure your automated funds work easily:

1. Automate your retirement contributions

Begin by automating your retirement financial savings. For those who haven’t already, ask your employer to routinely deduct a proportion of your pre-tax revenue on your 401(okay) or different retirement accounts.

Intention to contribute no less than sufficient to get your employer’s match if they provide one—free cash is all the time a good suggestion!

2. Construct your emergency fund and financial savings accounts routinely

Life is unpredictable, and having an emergency fund is essential. Arrange computerized transfers out of your checking account to your emergency fund each payday. This manner, you’re ready for the sudden, and also you gained’t be tempted to skip out on saving.

You can even take the identical strategy to your financial savings accounts on your different financial savings targets. This manner you don’t have to fret about spending this cash, forgetting to make a switch, or not having sufficient cash to save lots of.

In case you have an inconsistent revenue, you may set reminders in your calendar to schedule transfers to financial savings when you realize you’ll be making a deposit or receiving a confirmed cost.

Ensure that to construct all of this into your finances. It’s additionally an excellent concept to maintain your financial savings separate from the account the place you might have your every day transactions. You don’t wish to defeat the aim of automating your financial savings!

3. Create a finances round your post-automation stability

As soon as your retirement and financial savings contributions are automated, use the remaining stability to create your finances.

This ensures that your important payments and financial savings targets are coated first, leaving you with a transparent image of what’s left for discretionary spending.

There are a number of finances strategies to select from. So remember to choose a finances that most accurately fits your monetary scenario and targets.

4. Observe your invoice due dates

One of many few belongings you nonetheless must keep watch over is your invoice due dates. Ensure that your payments are scheduled to be paid after your payday to keep away from any overdraft charges.

The most effective methods to remain on prime of your due dates is to create a finances calendar (a finances in calendar type). It helps you keep in mind all your due dates and retains your funds on observe.

Some collectors and repair suppliers might allow you to select your cost date. You possibly can contact them to see if you happen to can change your due date to your pay date. This manner you’ll forestall any cash mishaps from lack of funds.

5. Recurrently evaluate your accounts

Even with every little thing automated, it’s essential to remain on prime of your accounts. Set reminders to evaluate your transactions and financial institution statements repeatedly. This helps you catch any errors, keep away from overdrafts, and keep accountable for your funds.

Professional tip: When automating your funds, contemplate establishing a buffer account

A buffer account is a separate, small checking account that acts as a monetary cushion. This account can be utilized particularly on your automated invoice funds.

By holding a modest stability right here (say, $500 or $1,000), you may make sure that sudden bills or timing discrepancies gained’t trigger overdrafts or missed funds.

This buffer offers you further peace of thoughts, understanding that your automated monetary system has a security internet in place.

What first step ought to I take to automate my funds?

Step one to automating your funds is establishing direct deposit along with your employer.

Direct deposit ensures that your paycheck is deposited into your checking account on a daily schedule, providing you with a dependable basis to work from. Realizing precisely once you’ll have entry to your funds lets you schedule different automated funds and transfers with confidence.

As soon as your direct deposit is in place, you may simply arrange computerized transfers to your financial savings and funding accounts.

By beginning with direct deposit, you’re laying the groundwork for a easy, automated monetary system. As soon as that is in place, you may transfer on to automating your invoice funds, financial savings, and investments.

How do I totally automate my funds?

To completely automate your funds, you’ll must arrange computerized processes for each side of your monetary life—from paying payments to saving and investing. Right here’s easy methods to do it:

- Arrange direct deposit: Guarantee your paycheck is straight deposited into your checking account. If doable, break up your paycheck so {that a} portion goes straight into your financial savings or funding accounts.

- Automate invoice funds: Enroll in computerized cost applications with all of your service suppliers (lease/mortgage, utilities, bank cards, loans, and so forth.). You are able to do this via every supplier’s web site or app, or use your financial institution’s invoice pay service to ship funds routinely.

- Automate financial savings contributions: Arrange computerized transfers out of your checking account to your financial savings accounts (emergency fund, trip fund, and so forth.) and funding accounts (401(okay), IRA, brokerage accounts). Intention to have these transfers occur shortly after your paycheck is deposited to make sure the cash is saved earlier than you might have an opportunity to spend it.

- Additionally contemplate automating debt repayments: For those who’re engaged on paying off debt, automate your mortgage or bank card funds in order that they’re made constantly on time. This can make it easier to keep away from late charges and pay down your debt extra effectively.

- Overview and modify: Even with every little thing automated, it’s essential to repeatedly evaluate your funds. Test your account balances, evaluate your transactions, and modify your automation settings as your monetary scenario or targets change.

By automating these features of your funds, you may decrease the guide effort required to handle your cash and keep on observe along with your monetary targets.

How do I automate my funds if my revenue is irregular?

In case you have an irregular revenue, automating your funds might sound tough, nevertheless it’s nonetheless doable. You possibly can arrange computerized transfers based mostly on a proportion of your revenue moderately than a set quantity.

Alternatively, you may manually modify your computerized funds every month, relying in your earnings. Setting calendar reminders to evaluate and modify your funds after every payday may also help you keep on observe.

How do I keep away from overdraft charges when automating funds?

To keep away from overdraft charges, guarantee your payments are scheduled to be paid after your payday. You can even arrange low-balance alerts along with your financial institution to inform you in case your stability drops beneath a sure threshold.

An alternative choice is to maintain a small buffer in your checking account to cowl any sudden shortfalls.

What are the potential downsides of automating my funds?

Whereas automating your funds is usually helpful, there are some things to be careful for. You may turn out to be too disconnected out of your spending, resulting in overspending in different areas.

Recurrently reviewing your transactions and statements may also help you keep conscious of your monetary habits.

Moreover, if you happen to overlook a couple of recurring cost, you may proceed paying for providers you now not want.

Articles associated to organizing your funds

In case you have discovered this text helpful, try this associated content material on getting financially organized:

Begin automating your funds right this moment!

Automating your funds may look like quite a lot of work upfront, however as soon as it’s finished, you’ll benefit from the peace of thoughts that comes with understanding your payments are paid on time, your financial savings are rising, and your monetary targets are on observe.

The important thing to profitable monetary automation is setting it up thoughtfully—direct deposit, automated financial savings, and strategic invoice funds are the constructing blocks of a strong plan. So why wait? Automate your funds right this moment, and watch your monetary stress soften away!

[ad_2]

Supply hyperlink